Importance of Recording

Cash Transaction for

Financial Accuracy

|||

- Home

- About Us

- Processes

-

Catalogue

By Module

- Finance

- HCM

- SCM

- Resources

- Simplified Services

- Contact

- Support Portal

-

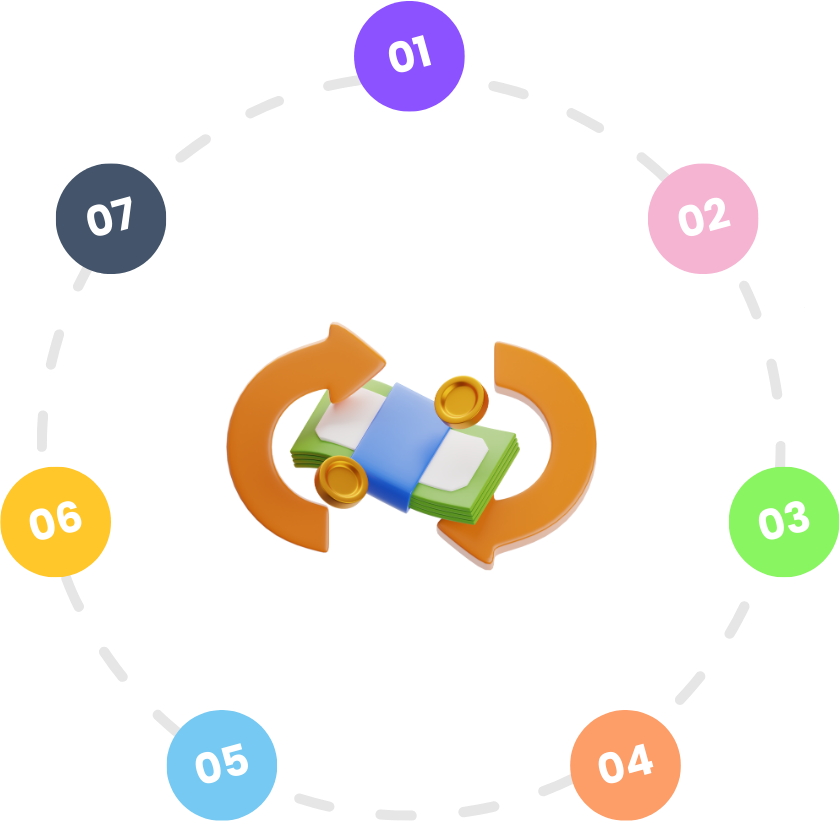

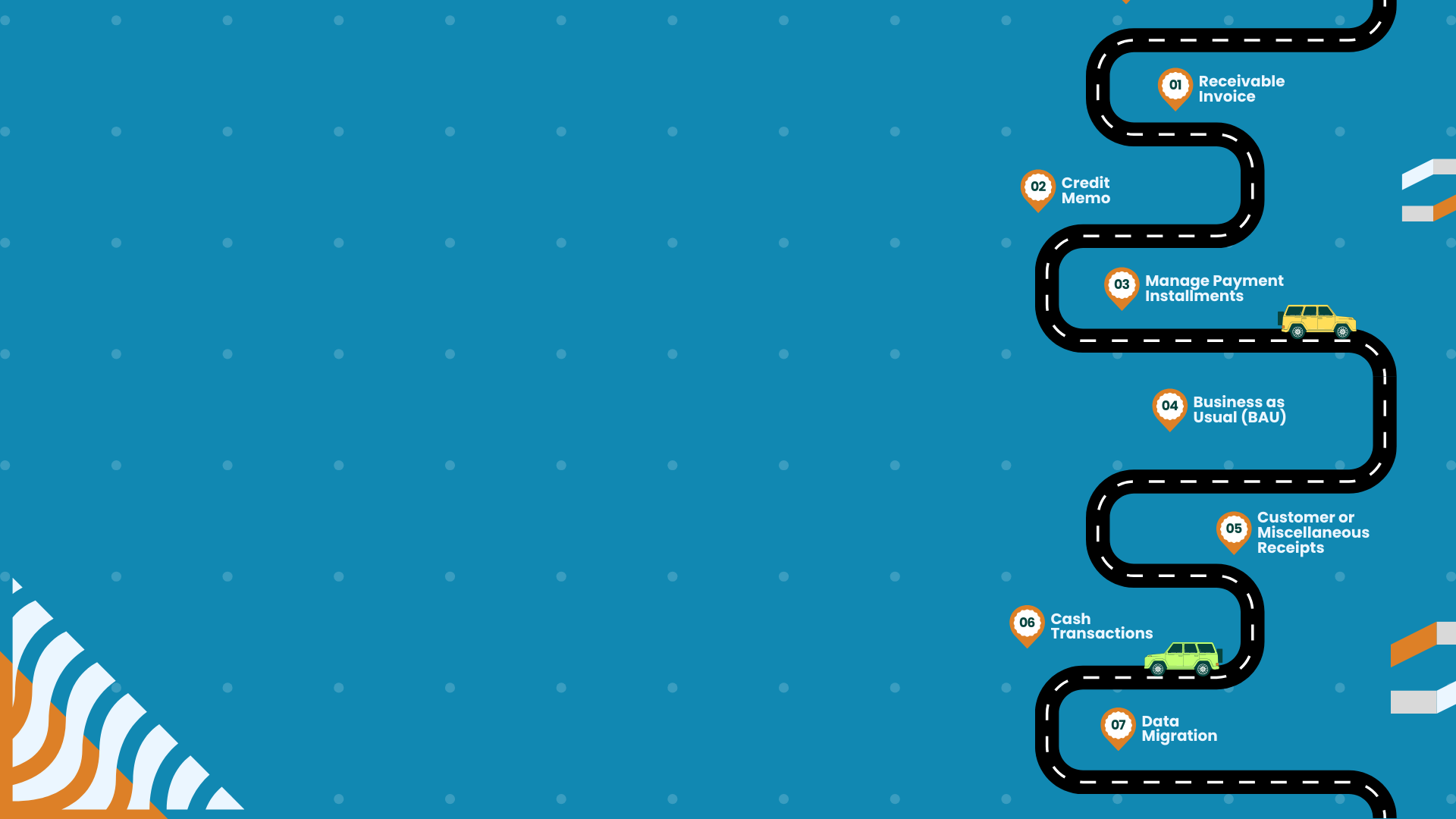

01

01

02

02

03

03

04

04

05

05

06

06

07

07

08

08

09

09

10

10